Why Term Insurance Deserves Your Attention

Let’s be real for a moment – Life doesn’t always give us a warning.

Both of us know someone who was here one day and gone the next, leaving their family not just with grief but with bills, EMIs, and unanswered questions.

That’s exactly why I always recommend looking at term insurance early on.

Not because it’s a product to tick off your financial checklist but because it’s something that can make a huge difference for the people you care about the most.

Now, if you’re exploring term plans, chances are Tata AIA has come up on your radar. And rightly so, the company has a strong claim settlement track record and a bunch of term plans to choose from.

But here’s where things get tricky:

“Which Tata AIA term plan should I actually go for?”

That’s the question I get asked all the time, and honestly, the answer depends on your life situation, budget, and how much protection you’re really looking for.

So, in this guide, I’m breaking it all down:

- What term insurance is and how it works

- The 3 best Tata AIA term plans (with real examples)

- Who should buy which plan?

- How much coverage you really need

- And much more!

Table of Contents

What is Term Insurance (and Why You Need It)?

Term insurance is the simplest and purest form of life insurance. You pay a premium every year (or monthly), and in return, your family gets a large sum assured (₹50 lakhs, ₹1 crore, etc.) if you pass away during the policy term.

Why is term insurance so popular?

Just one line answer – Because it gives high coverage at very low premiums. No investment returns, no maturity bonus, just pure financial protection.

Let’s understand with an example:

Let’s say Ravi, age 30, is the sole earner in his family. He could get a ₹1 crore term plan for 30 years at just around ₹1,000 per month.

Unfortunately, if something happens to him during the term, his nominee will get ₹1 crore (tax-free). That’s how powerful term insurance is.

Note: Premium amount may vary subject to age, policy term and smoking habits.

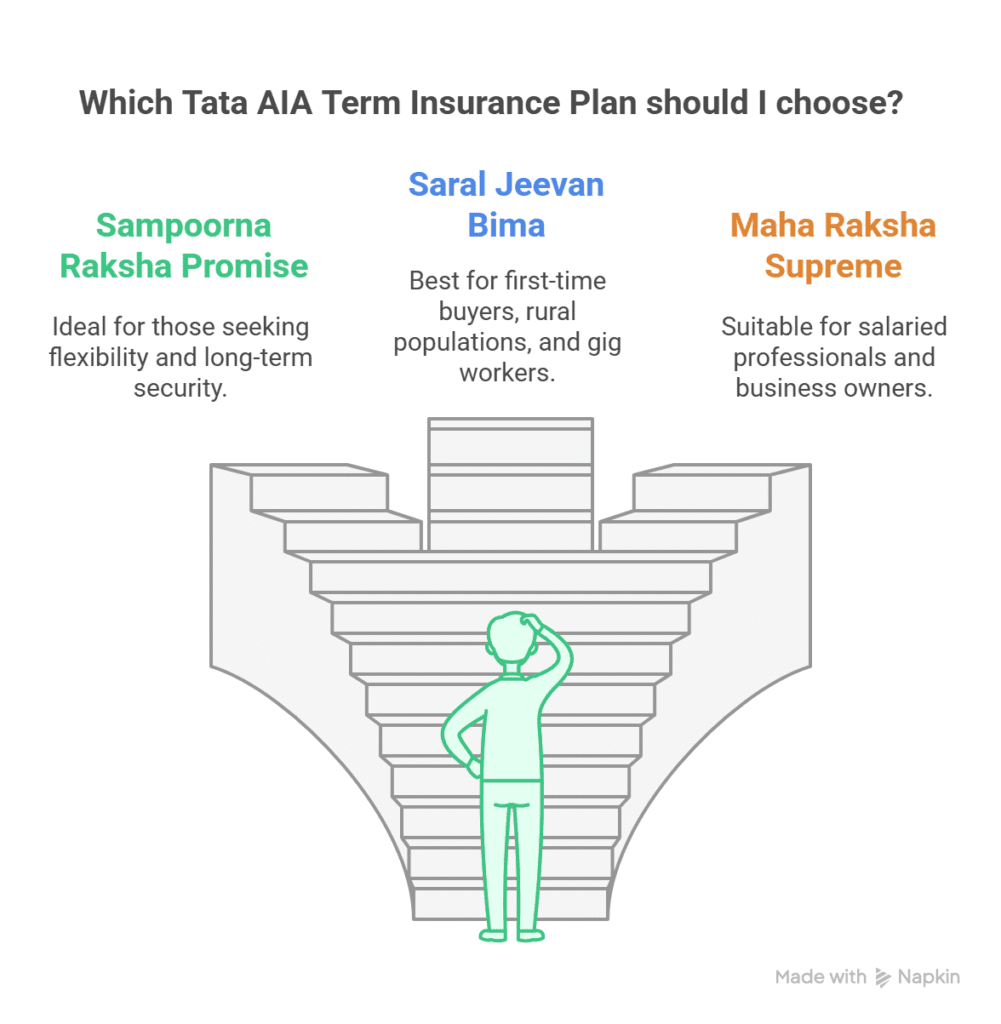

Top 3 Tata AIA Term Insurance Plans You Should Know

Tata AIA has several term plans, but these three are the most popular and practical across different life stages and needs.

1. Tata AIA Sampoorna Raksha Promise

This is a comprehensive term plan with multiple options, including:

- Life cover till 85 or even whole life (up to 100 years)

- Return of Premium option (you get your premiums back if you survive)

- Income payout option (monthly income instead of lump sum)

Best for: People who want flexibility and long-term security

Bonus: You can add critical illness or accidental riders

2. Tata AIA Saral Jeevan Bima

A simple and affordable plan launched under IRDAI guidelines to make term insurance accessible to all.

- No complicated features — just pure life cover

- Minimum documentation

- Ideal for people with unstable income, low insurance awareness, or those buying their first policy

Best for: First-time buyers, rural populations, gig workers

USP: Same terms across all insurers = Easy to compare

3. Tata AIA Maha Raksha Supreme

One of Tata AIA’s flagship term plans with:

- High coverage up to ₹5 crores

- Options to cover till age 85

- Pay till 60 and stay covered till 85

- Flexible death benefit payout options

Best for: Salaried professionals, business owners, or anyone looking for solid long-term protection

Bonus: Can opt for riders and income payout

Let’s Compare All Tata AIA Term Insurance Plans at a Glance:

| Feature | Sampoorna Raksha Promise | Saral Jeevan Bima | Maha Raksha Supreme |

| Entry Age | 18 to 60 years | 18 to 65 years | 18 to 70 years |

| Max Maturity Age | 100 years | 70 years | 85 years |

| Policy Term | 10 – 100 years | 5 – 40 years | 10 – 85 years |

| Minimum Sum Assured | ₹50 lakhs | ₹5 lakhs | ₹50 lakhs |

| Premium Payment Term | Regular / Limited / Single | Regular | Regular / Limited / Single |

| Return of Premium Option | Yes | No | No |

| Riders Available | Yes (CI, Accidental, etc.) | No | Yes (CI, Accidental, etc.) |

| Payout Option (Monthly/Combo) | Yes | No | Yes |

| Best For | Long-term planning, flexibility | Basic life cover | Professionals, high coverage |

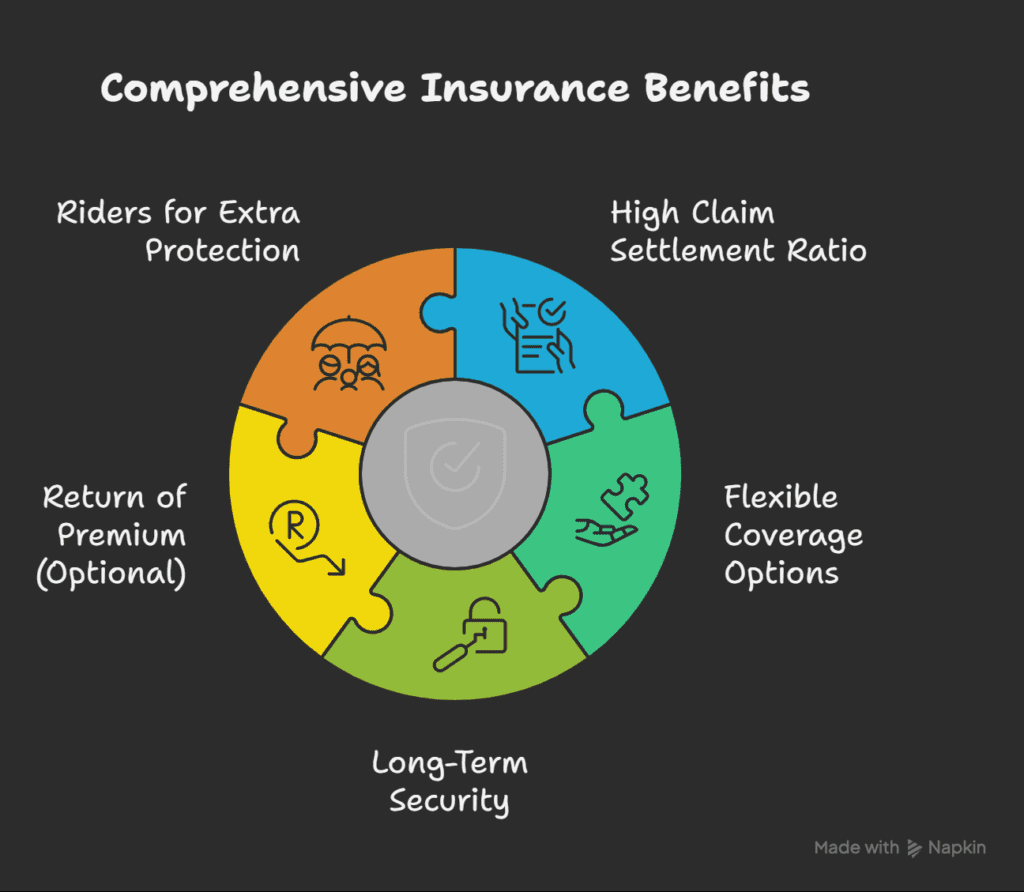

Key Features & Benefits of Tata AIA Term Insurance Plans

High Claim Settlement Ratio

Tata AIA boasts a claim settlement ratio of 99.01% (FY 2022-23) — meaning your family is almost guaranteed to receive the benefit.

Flexible Coverage Options

Choose between lump sum, monthly income, or a mix — based on what’s best for your family’s lifestyle.

Long-Term Security

Get covered up to 100 years of age (in Sampoorna Raksha Promise) — ensures peace of mind even after retirement.

Return of Premium (Optional)

Don’t like the idea of “losing money” if you survive the term? This option lets you get back all paid premiums if no claim is made.

Riders for Extra Protection

Add critical illness, accidental death, waiver of premium, and more for enhanced security.

Who Should Buy What? Matching Plans with Life Stages

| Profile Type | Recommended Plan | Why It’s a Good Fit |

| Freshers | Saral Jeevan Bima | Affordable, easy to understand, basic protection |

| Married with Kids | Sampoorna Raksha Promise | High cover + family income option + return of premium |

| Business Owners | Maha Raksha Supreme | High flexibility and large cover for business continuity |

| 40+ Years with Loans | Sampoorna Raksha Promise | Coverage till 100 years + waiver of premium + loan protection |

| Gig Workers/Self-Employed | Saral Jeevan Bima | Simple plan, low documentation, stable protection |

Real-life Example:

Neha (name for representation), 35, is a working mother of two with a ₹60L home loan and ₹10L in other liabilities. She chooses Sampoorna Raksha Promise with:

- ₹1 crore sum assured

- 30-year policy

- Monthly payout for her family

- Critical illness rider

This ensures her family is financially secure even if she’s not around.

How Much Term Insurance Cover Do You Really Need?

A good rule of thumb is:

- 20X your annual income

- Or, cover all your liabilities + future goals (kids’ education, marriage, etc.)

Coverage Planning Formula:

(Annual Expenses × No. of Years) + Loans + Future Goals – Current Savings

Let’s say:

- Annual expenses: ₹5 lakhs

- Years till kids become independent: 20

- Home loan: ₹50 lakhs

- Other goals: ₹30 lakhs

- Savings: ₹10 lakhs

Ideal Cover = (5L × 20) + 50L + 30L – 10L = ₹1.7 crore

Pro Tip: If you have difficulty calculating the premium, you can book a free consultation with me to get your personalised estimate.

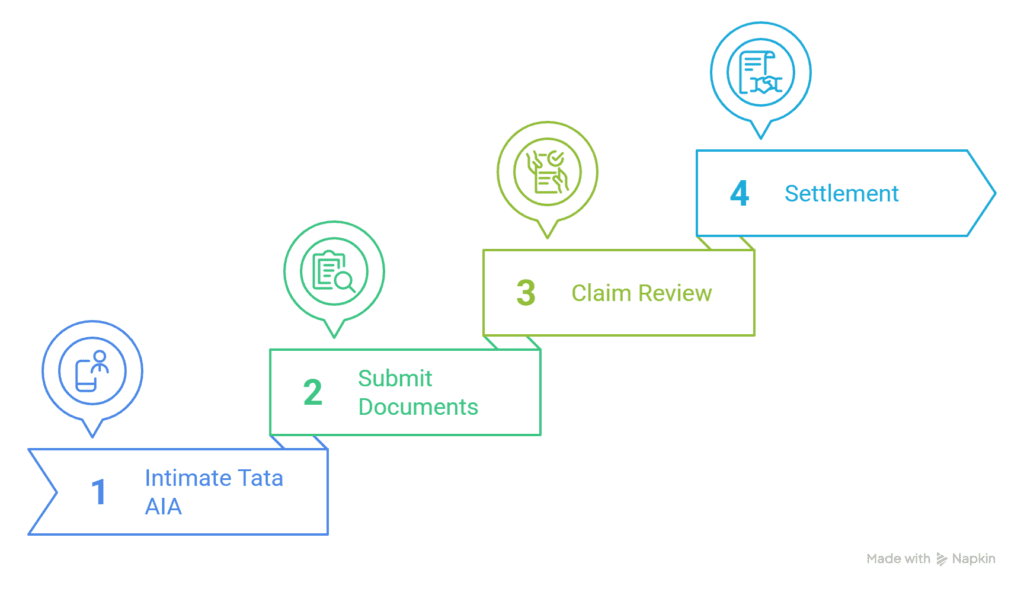

How to Claim Term Insurance: Step-by-Step Process

In case of the policyholder’s death, the nominee must follow these steps:

- Intimate Tata AIA – Online, branch visit, or customer care

- Submit Required Documents:

- Death certificate

- Policy documents

- ID proof, bank details, etc.

- Death certificate

- Claim Review by Insurer

- Settlement – Within 7–15 working days (if all papers are in order)

Pro Tip: Always keep nominee details updated and inform your family about the policy.

FAQs

Can I buy Tata AIA term plans online?

Yes, most plans can be bought directly from Tata AIA’s website or through an advisor for guided help.

Is a medical test compulsory?

For high cover amounts or older ages, yes. But it’s a good thing—it avoids claim issues later.

Can I change the nominee later?

Absolutely. You can update nominee details anytime during the policy term.

What if I miss a premium payment?

You get a grace period (15-30 days). If you still don’t pay, the policy may lapse.

Should I take riders with the term plan?

Yes, especially the Critical Illness and Accidental Death Benefit — they offer extra protection at a minimal cost.

Conclusion: Should You Choose Tata AIA for Term Insurance?

At the end of the day, buying term insurance isn’t about ticking a box — it’s about protecting what matters most. Your spouse, your kids, your parents… the people who’d be left to pick up the pieces if something were to happen.

I recently spoke to a client, Ramesh, a 34-year-old father of two from Bangalore. He had a home loan and school fees and was the only earning member.

He told me,

“I always thought I had time to figure this out, but after my friend passed away suddenly, I knew I needed to act.”

We looked at his life stage, income, and future responsibilities — and he eventually went with Tata AIA’s Sampoorna Raksha Promise because it gave him the right balance of coverage and flexibility.

You don’t need to be an expert to make the right call, but you do need to take the first step.

Here’s what I suggest:

- If you’re looking for a low-cost plan with basic life cover, start with Saral Jeevan Bima.

- If you want flexibility, riders, and return of premium options, explore Sampoorna Raksha Promise.

- And if you’re thinking long-term with higher protection, look into Maha Raksha Supreme.

Still confused? That’s okay. It’s a big decision and you don’t have to make it alone.

Want help figuring out which plan is right for you?

I’d be happy to walk you through it.

NO Pressure

NO Jargon

JUST REAL ADVICE.

Next step:

Check out our in-depth reviews on each of the 3 Tata AIA plans to get a better feel:

Tata AIA Sampoorna Raksha Promise – Full Review

Tata AIA Saral Jeevan Bima – Full Review

Tata AIA Maha Raksha Supreme – Full Review

If you are looking for something other than term plans, the TATA AIA Overview might help you.

Let’s take the confusion out of insurance one step at a time.

1 thought on “Tata AIA Term Insurance Plans: A Complete Guide”

Comments are closed.